The following valuation yields a value of € per share using only information available in the historical cost financial statements.

1. The historical cost numbers

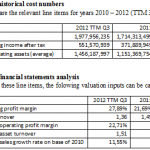

Here are the relevant line items for years 2010 – 2012 (TTM 3Q) in €

We employ a standard residual income valuation model that calculated missing value in the balance sheet from a forecast of forward (2013) operating income.

Value of Equity = Book Value of Equity2012TTM + Residual Income from Operations2013 / (Required Return – Growth Rate)

Residual Income from Operations2013 = Forecasted Operating Income2013 – (Required Return x Net Operating Assets2012 TTM)

Only the residual income from operations is forecasted because residual earnings from interest on net debt are usually close to zero.

4. The forecast

For the required return we will use 17,53% whice is appoaximately the Tresury rate of 7,25% plus a risk premium of 5,4% plus a country risk premium 4,88%.

- If boath the profit margin and the asset turnover are constant, then residual operating income grows at the sales growth rate.

- The historical financial statements supply a forecast of operating income and residual operating income:

Forecasted sales of 2013 = Sales for 2012TTM x (1 + Average sales growth rate)=

= 2,206, 410, 180€

Forecasted operating income for 2013 = Sales for 2013 x Average profit margin =

= 500,965,800€

Forecaste residual operating income for 2013 = 298,349,027€

5. The valuation

With a 2012TTM book value of 1,057,244,874€, the calculated value with these inputs is:

Value of Equity = 1.057,244,874 + 298349027/(0,1753-0,1155) = 6,046,359, 038 € or 37,08 per share.

NOTE: Is necessary to apply a corection factor for the marketability and the difference in inflation rates in

the EU and Serbia.

37,08 x 0,70 = 25,96 per share

Макроекономија Економске анализе, Србија, окружење, и међународна економија

Макроекономија Економске анализе, Србија, окружење, и међународна економија